Understanding Việt Nam’s Political Future Through the 14th Party Congress

While conventions are routine political events, there are a few gatherings that shape a nation’s direction and destiny. The

Thiên Lương wrote this article in Vietnamese and published it in Luật Khoa Magazine on August 19, 2025.

Recent reports reveal a troubling reality behind Vingroup's aggressive expansion: the conglomerate is operating under a perilous level of debt. The company, owned by Vietnam's wealthiest man, Phạm Nhật Vượng, is burdened with liabilities totaling 31 billion USD. This figure requires $ 3.2 million in daily interest payments on its international credit loans.

This financial strain suggests that the glittering image polished by domestic media may be concealing a bleak and uncertain future, as Vingroup's own Q2/2025 financial report and business results sketch an unvarnished portrait of a high-profile conglomerate whose foundation appears to be riddled with risk.

Vingroup’s debt surged by approximately 4.7 billion USD in the first six months of the year, bringing its total liabilities to a staggering 31 billion USD by the end of Q2/2025. This figure represents 86% of the company’s total assets.

The immediate pressure comes from short-term liabilities, which comprise over 19.5 billion USD (63%) of the total debt and are approaching maturity. The cost of servicing this debt is substantial, with interest payments exceeding 295 million USD in the second quarter alone—equivalent to 3.2 million USD per day across Vingroup's ecosystem. The company faces significant deadlines next year, including 860 million USD in credit loans and 1.14 billion USD in bond interest coming due.

To manage these obligations with just over 3 billion USD in cash on hand, Vingroup has been actively raising capital. The company recently generated 1.6 billion USD by selling 41.5% of its shares in Vincom Retail. Vingroup Chairman Phạm Nhật Vượng also secured over 1 billion USD in new credit from international lenders like Deutsche Bank AG and the Asian Development Bank, with 510 million USD of that amount designated for the subsidiary VinFast.

Table: List of Vingroup's payables in the financial report of the second quarter of 2025. Source: Vingroup.

Despite immense daily interest payments, Vingroup’s recent business reports project an image of resilience, enabling the conglomerate to secure new loans for ambitious projects. The foundation for this confidence, however, appears to be highly irregular figures in its financial statements.

The Q2/2025 report provides a stark example. While it records a post-tax profit of 2.265 trillion đồng, this positive figure is entirely manufactured by a single line item: an "other income" entry of 18.516 trillion đồng, which Vingroup vaguely attributes to "sponsorship funds." Without this unexplained infusion, the conglomerate's core business operations would have posted a massive loss of more than 13.9 trillion đồng.

This reliance on non-business cash is a recurring theme. The only clarified major inflow came from Chairman Phạm Nhật Vượng himself, who injected 23 trillion đồng in the past quarter, just three months after a similar 5 trillion đồng transfer. Likewise, in 2024, a personal cash injection of around 10 trillion đồng from Vượng was what allowed Vingroup to report a profit.

This pattern of financial irregularities is not confined to the company’s domestic operations. In July 2024, its subsidiary VinFast was rebuked by the U.S. Securities and Exchange Commission (SEC) for inflating revenues in a filing. The SEC rejected the report, forcing VinFast to admit that "accounting errors" had caused it to overstate sales by 33.9 million USD.

Table: Vingroup's cash flow statement in the second quarter of 2025.

The red flags surrounding Vingroup’s financial health are not a recent development. The warnings began as early as 2019, when the credit agency Fitch Ratings downgraded the conglomerate’s outlook from “Stable” to “Negative,” citing the “cash-burning” investments in its subsidiary VinFast. Instead of adjusting its strategy, Chairman Phạm Nhật Vượng withdrew Vingroup from Fitch’s rating program, effectively removing a key mechanism for monitoring its soaring debt.

As the conglomerate’s debt continued to climb, the warnings have grown louder. Financial platforms like Alpha Spread now classify Vingroup as a high-risk company, while the German assessment firm Simply Wall estimates its business profits can cover only 40% of its interest expenses. Consequently, major foreign investors have begun to “flee,” dumping nearly all of their Vingroup shares.

Recent filings with the U.S. Securities and Exchange Commission (SEC) reveal the severity of the current situation. Vingroup is acting as a guarantor for VinFast’s 2.54 billion USD debt and is obligated to settle over 1.6 billion USD of that amount in 2025. This debt is made even more precarious by a significant currency mismatch: 41% of the interest on Vingroup’s total debt is in U.S. dollars, while 92% of VinFast’s revenue comes from the domestic market, where the Vietnamese đồng continues to depreciate.

To secure these massive loans, Vượng has pledged a vast portfolio of assets, including production lines in Hải Phòng, the VinES battery factory in Hà Tĩnh, and even the under-construction EV plant in North Carolina.

Since its founding in 2017, VinFast has never made a profit, acting instead as a massive financial drain on its parent company. This cash burn is the primary driver of Vingroup's deteriorating financial health, which began in 2021 when the conglomerate posted its first major loss, after many years of steady profitability. In the first half of 2025 alone, VinFast’s automotive business lost over 37 trillion đồng—a deficit that Vingroup’s core real estate profits failed to cover.

Table: Summary and Comparison of Income from Automobile-related Business (VinFast) and Real Estate Transfer of Vingroup from 2018 to present (quarter 2/2025). Unit: Million VND. Source: Vingroup Financial Statements.

This situation is the direct result of Chairman Phạm Nhật Vượng’s ambition to expand electric vehicle sales into the U.S. and European markets.

“We regard the U.S. as the key market, a test to measure effectiveness. […] If we succeed in America, conquering other markets will be much easier,” Vượng stated in a May 2020 Shareholders’ Meeting.

The venture launched in late 2022 with a shipment of 999 VF8 vehicles and the groundbreaking of a factory in North Carolina. However, instead of “securing Việt Nam’s place on the global automotive map,” VinFast’s American dream quickly soured. By May 2023, the entire initial shipment was returned for failing to meet safety standards.

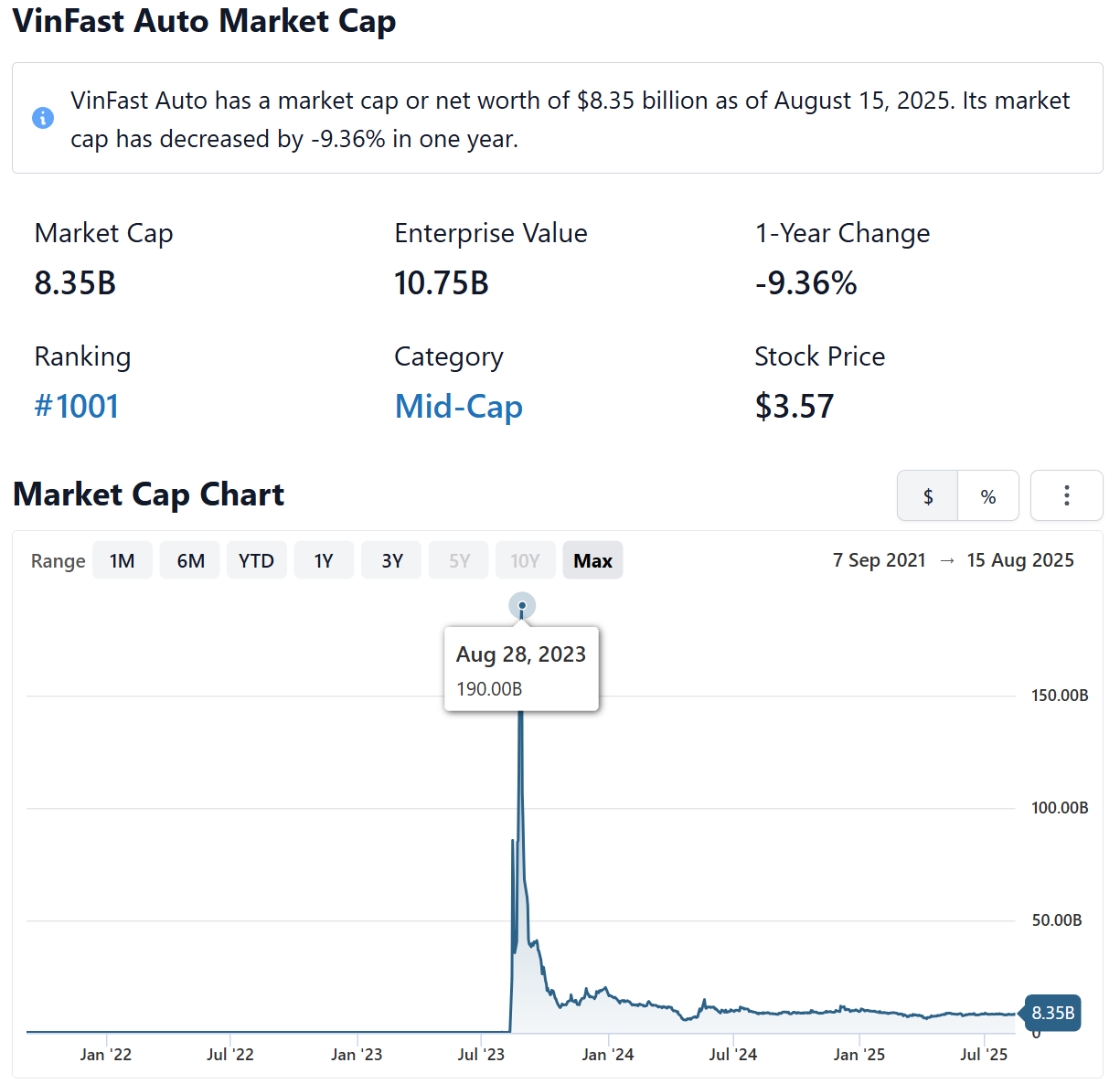

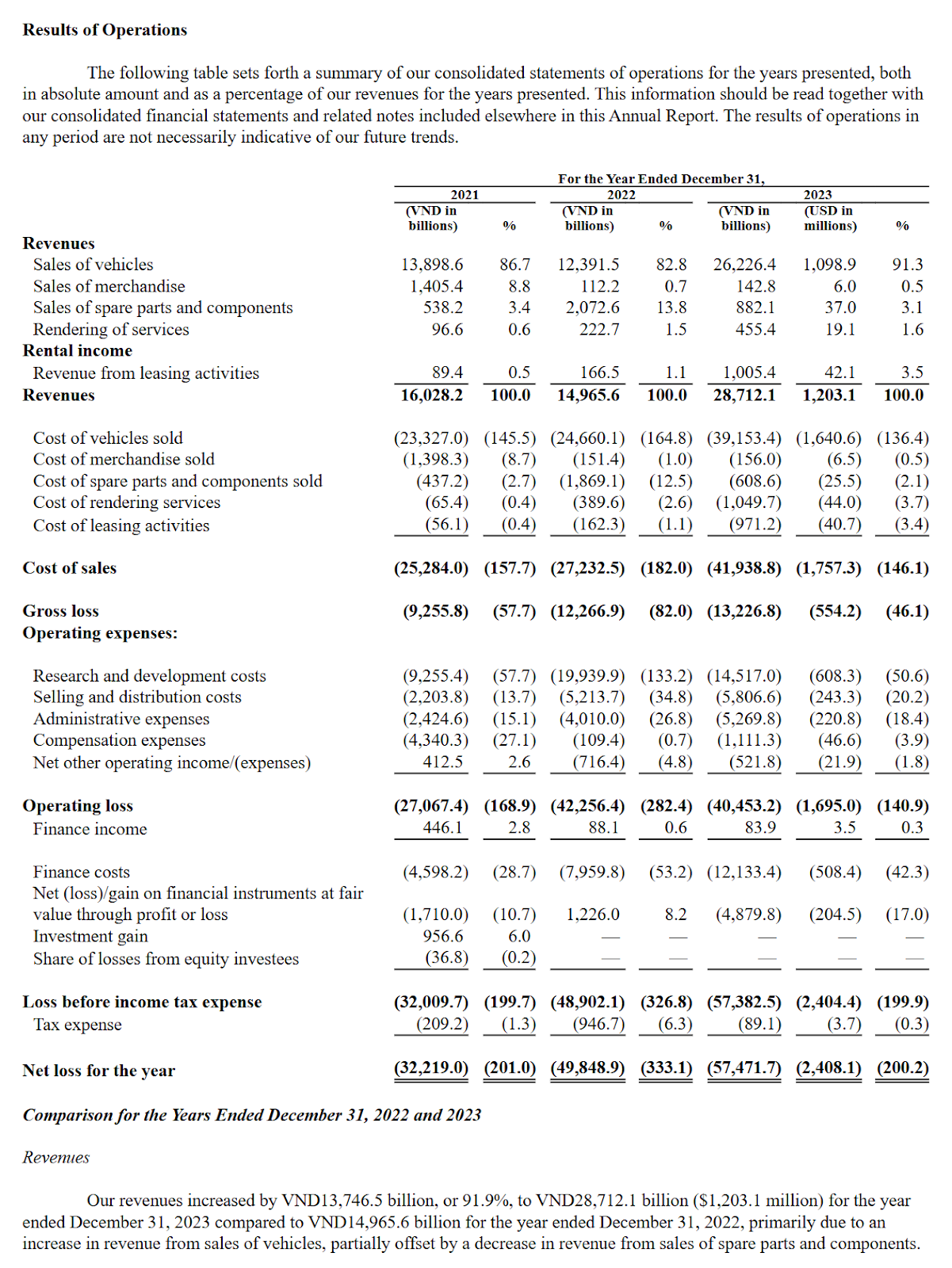

Despite this, VinFast listed on the Nasdaq in August 2023 with a market capitalization of over 23 billion USD. The stock collapsed by more than 90% within two months. This implosion led to a class-action lawsuit by shareholders in May 2024, alleging the company had exaggerated its prospects, which in turn prompted an SEC investigation. As of Aug. 15, 2025, VinFast’s market cap has dwindled to 8.35 billion USD.

Operationally, VinFast has shuttered its U.S. showrooms and postponed its factory construction. Financially, the losses are staggering: 554.2 million USD in 2023 and nearly 3.2 billion USD in 2024. Yet, Vượng remains defiant, vowing in April 2024 to "never give up on VinFast" and planning to make the company break even by the end of 2026. However, this would require recouping a cumulative investment of over 20 billion USD and settling over 10 billion USD in debt.

This raises an important question: given the financial realities detailed in Vingroup's own reports, is Vượng’s plan to bring VinFast to break-even truly realistic?

Vietnam's independent news and analyses, right in your inbox.